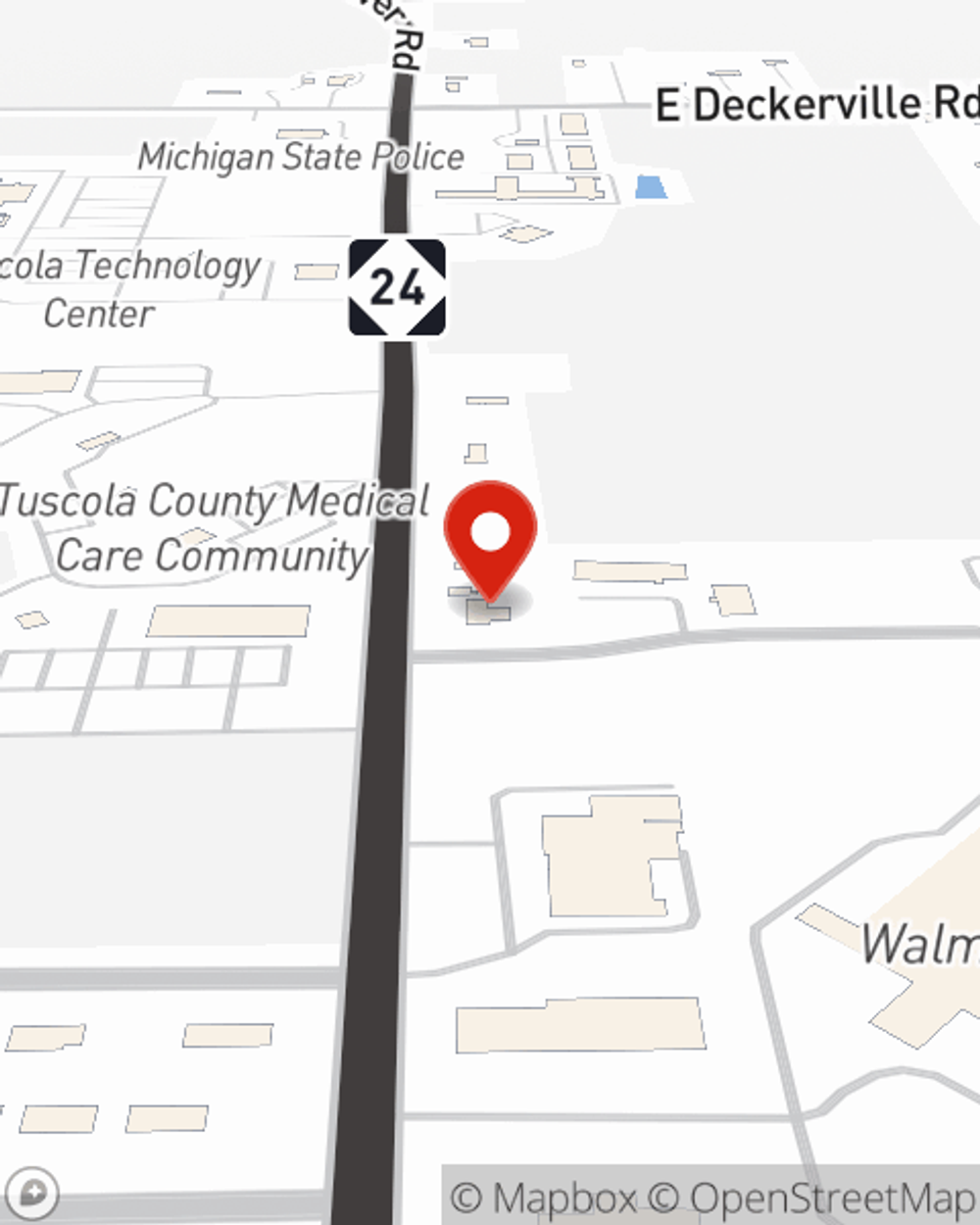

Condo Insurance in and around Caro

Get your Caro condo insured right here!

Insure your condo with State Farm today

Your Search For Condo Insurance Ends With State Farm

Looking for a policy that can help insure both your unit and the mementos, sound equipment, clothing? State Farm offers incredible coverage options you don't want to miss.

Get your Caro condo insured right here!

Insure your condo with State Farm today

Protect Your Condo With Insurance From State Farm

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Chris Barrios can be there whenever mishaps occur to help you submit your claim. State Farm is there for you.

Intrigued? Agent Chris Barrios can help walk you through your options so you can choose the right level of coverage. Simply call or email today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Chris at (989) 672-3276 or visit our FAQ page.

Simple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Chris Barrios

State Farm® Insurance AgentSimple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.